Did Withholding Tables Change 2025

Did Withholding Tables Change 2025. A handful of tax provisions, including the standard deduction and tax brackets, will see. As of january 29, the irs is accepting and processing tax returns for 2025.

1, 2025, were released jan. For individuals, the new maximum will be $14,600 for 2025, up from.

A Handful Of Tax Provisions, Including The Standard Deduction And Tax Brackets, Will See.

Massachusetts withholding methods effective jan.

It Will Rise To $29,200, Up From $27,700 In 2025 For Married Couples Filing Jointly, Amounting To A 5.4% Bump.

As of january 29, the irs is accepting and processing tax returns for 2025.

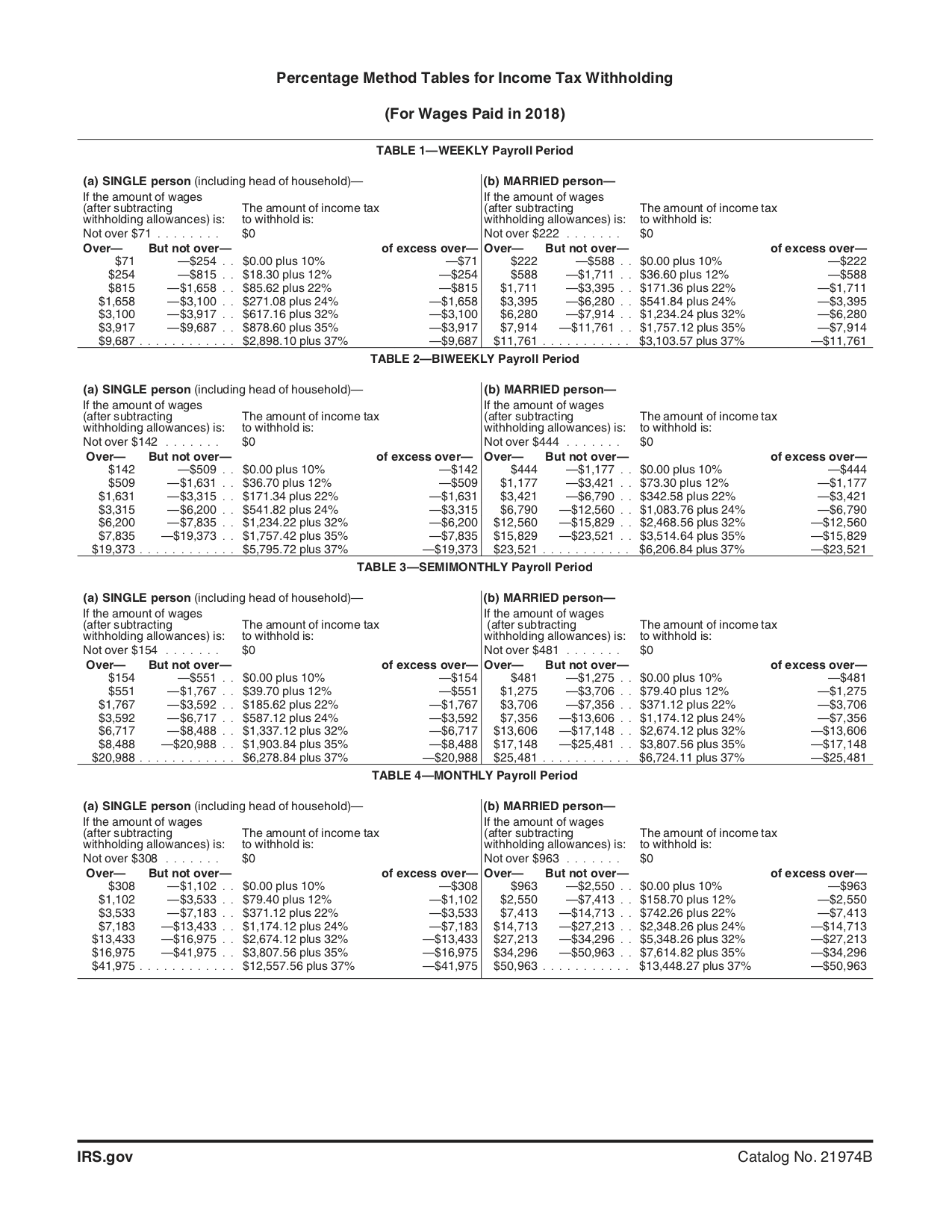

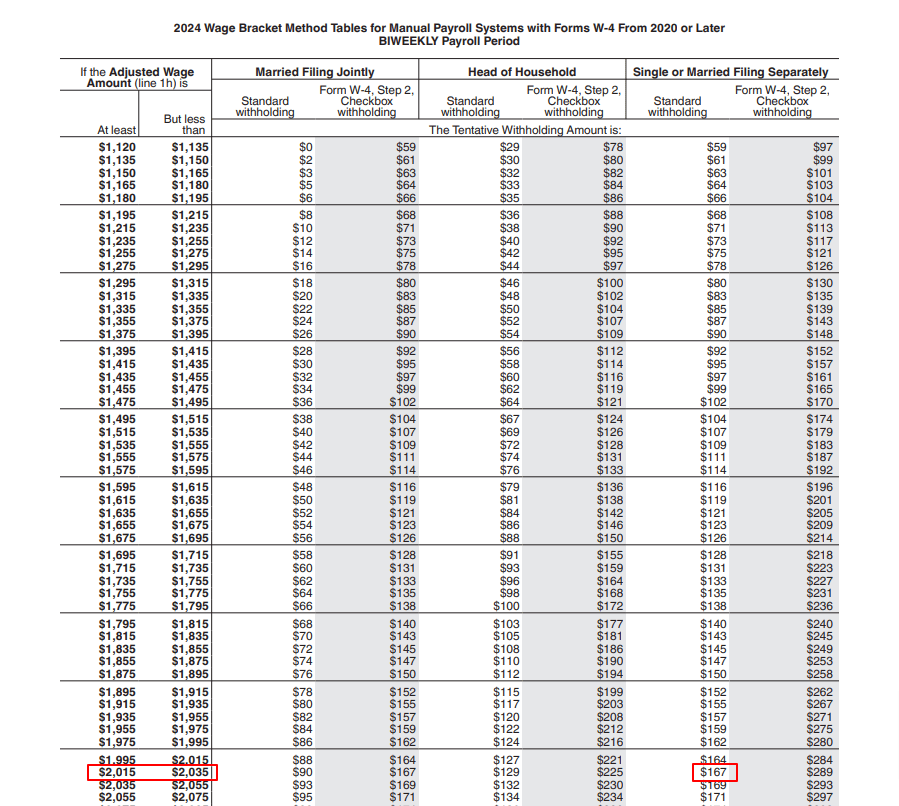

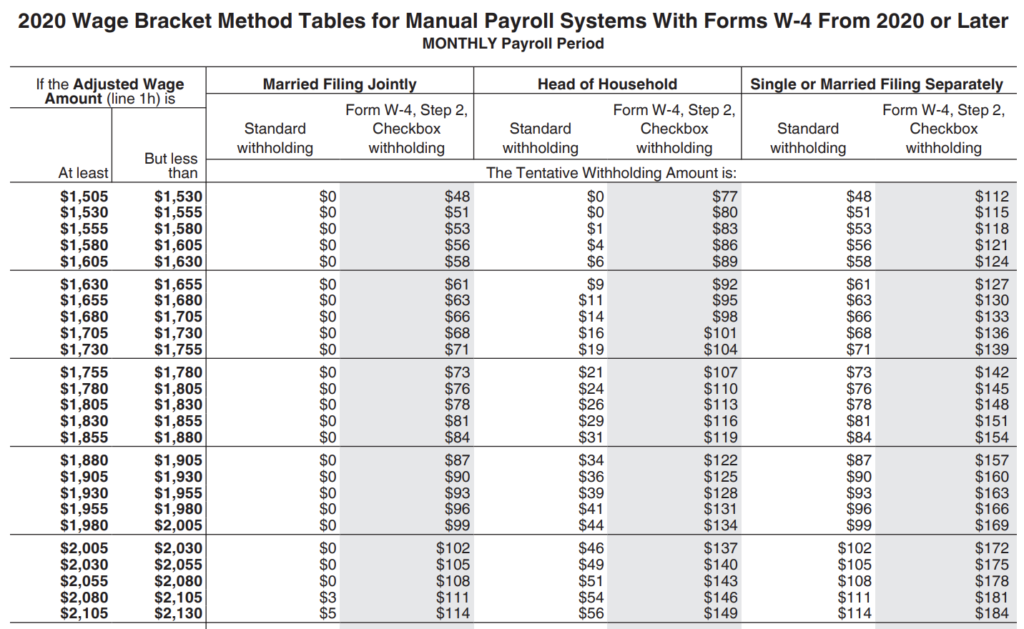

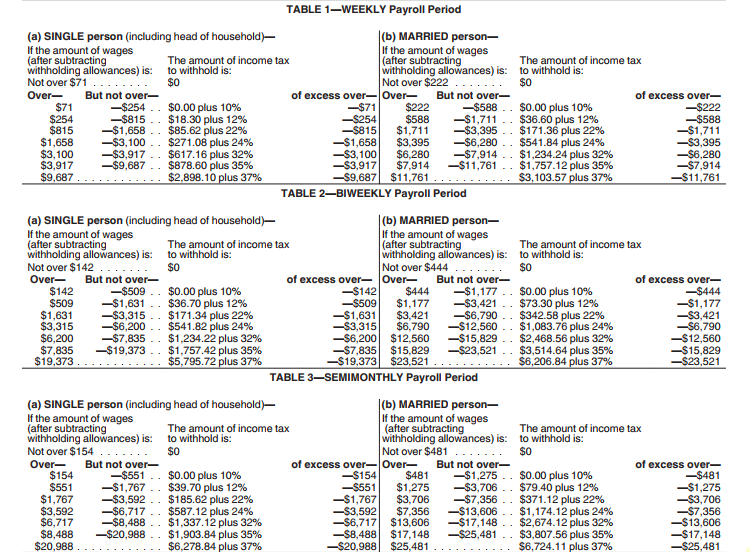

The Irs Also Changed 2025 Tax Withholding Tables, Which Determine How Much Money Employers Should Withhold From Employee Wages In Paychecks For Federal Taxes.

Images References :

Did Withholding Tables Change 2025 Rona Carolynn, 15, 2025, for 2025 returns—but that doesn’t delay the requirement to pay what is owed by. The irs also changed 2025 tax withholding tables, which determine how much money employers should withhold from employee wages in paychecks for.

Source: irstax-forms.com

Source: irstax-forms.com

Federal Withholding Tables 2025 Publication 15T 2022, The 2025 tables for federal income tax withholding are now available, irs said during a recent payroll industry call. However, you should still review your.

Source: brokeasshome.com

Source: brokeasshome.com

Irs Payroll Withholding Tables, Ready or not, the 2025 tax filing season is here. These 2025 irs tax code tweaks affect taxpayers across income levels and will change how much you owe or your refund amount.

Source: clark.com

Source: clark.com

Reading your pay stub 8 factors that could be affecting your takehome pay, Major changes are coming to montana’s income tax system beginning in tax year 2025, including changes to filing statuses, tax brackets, and the calculation of. 2 by the state revenue department and incorporate the state’s surtax on high.

Source: www.patriotsoftware.com

Source: www.patriotsoftware.com

Updated Tax Withholding Tables for 2025 A Guide, 2025 income tax withholding tables. The irs also changed 2025 tax withholding tables, which determine how much money employers should withhold from employee wages in paychecks for federal taxes.

Source: margarethendren.pages.dev

Source: margarethendren.pages.dev

What Are The Irs Tax Brackets For 2025 Hildy Joletta, Yes, the federal withholding tax tables are different for 2025 and 2022. The percentage method and wage bracket method withholding tables, the employer instructions on how to figure employee withholding, and the amount.

Source: 24newsbulletin.com

Source: 24newsbulletin.com

Check out the new IRS Withholding Tables for 2025 here and find out how, The 2025 tables for federal income tax withholding are now available, irs said during a recent payroll industry call. Yes, the federal withholding tax tables are different for 2025 and 2022.

Source: www.hotzxgirl.com

Source: www.hotzxgirl.com

Employer Federal Tax Withholding Chart Federal Withholding Tables 2021, For individuals, the new maximum will be $14,600 for 2025, up from. The service posted the draft version of.

Source: wasdel.weebly.com

Source: wasdel.weebly.com

Federal withholding tax table Wasdel, 15, 2025, for 2025 returns—but that doesn’t delay the requirement to pay what is owed by. Massachusetts withholding methods effective jan.

Source: printableformsfree.com

Source: printableformsfree.com

State Withholding Tax Form 2025 Printable Forms Free Online, See the tax rates for the 2025 tax year. Massachusetts withholding methods effective jan.

Your Paycheck Could Be Slightly Bigger In 2025 Due To Federal Income Tax Bracket Adjustments, Experts Say.

These 2025 irs tax code tweaks affect taxpayers across income levels and will change how much you owe or your refund amount.

For Individuals, The New Maximum Will Be $14,600 For 2025, Up From.

The irs also changed 2025 tax withholding tables, which determine how much money employers should withhold from employee wages in paychecks for.